(Sponsored)

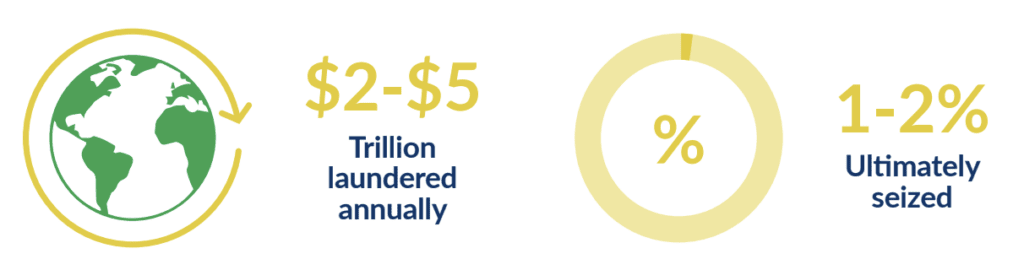

In today’s world, financial criminals are often a step ahead of regulators and financial institutions who struggle to effectively guard against the threat of money laundering and financial crime. It was once estimated by the International Monetary Fund (IMF) that money laundered throughout the world on an annual basis can be up to 2% – 5% of the global GDP ($2 – $5 trillion based on today’s figures) with only 1 – 2% of the illicit funds ultimately being seized. As a result, compliance and operations professionals are on edge as they attempt to juggle multiple priorities with looming threats of severe financial losses, fines/penalties, adverse operational impacts, and reputational damage.

Unsurprisingly, a recent survey by Corporate Compliance Insights reveals significant hurdles to getting the job done. Out of 240 compliance officers surveyed across industries, nations, and job levels, 53% said they lack the resources to perform their job to its full potential, 40% lack organizational support and 59% feel burned out. There is no doubt that working in Compliance and Operations is a tough way to make a living and the road ahead will not get easier.

In speaking directly with senior leaders from across the…