tiero

The video version of this article was published on Dividend Kings on Tuesday, March 21.

The banking crisis of 2023 is a crisis of confidence, not asset quality. Unfortunately, it’s likely to persist for several months.

The good news is that we’re not going to see another GFC style economic meltdown. The bad news?

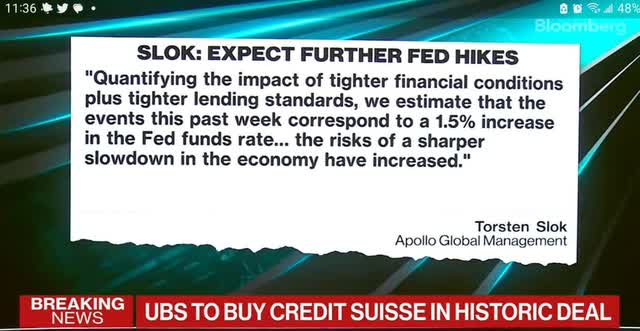

Bloomberg

With an estimated 186 regional banks at high risk of failing, 7% of all US banks, credit is expected to dry up quickly.

As a result, an estimated 25 basis points to 150 basis points of effective Fed hikes are coming soon.

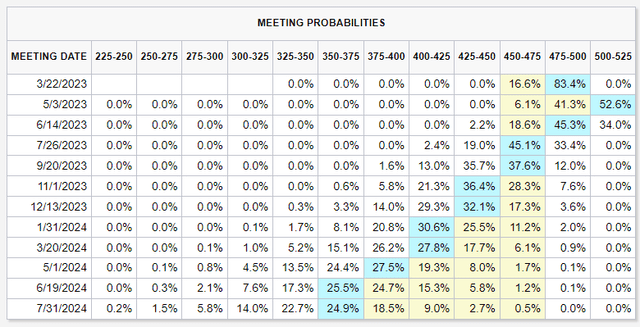

CME Group

The bond market thinks the Fed will hike to 5% in May before the rate hikes end, which means effectively:

- 5% fed funds rate

- + 0.25% to 1.5% credit contraction

- + 0.75% to 2% QT (reverse money printing)

- 6% to 8.5% effective Fed funds rate

The Fed has never hiked from 0% to 6% or more without a recession, and the bond market thinks one could start as soon as July.

Wells Fargo thinks a 1.2% GDP contraction is starting in Q4 and will run through Q1 of 2024.

For context, that’s one-third the severity and magnitude of the Great Recession and on par with the historical average recessionary 1.4% contraction since WWII.

But it’s one…