Many of us take for granted the ability to withdraw money from our bank account, wire it to family in another country, and pay bills online.Amid the global pandemic, we’ve seen how much digital connection matters to our everyday life. But what if a cyberattack takes the bank down and a remittance doesn’t go through?

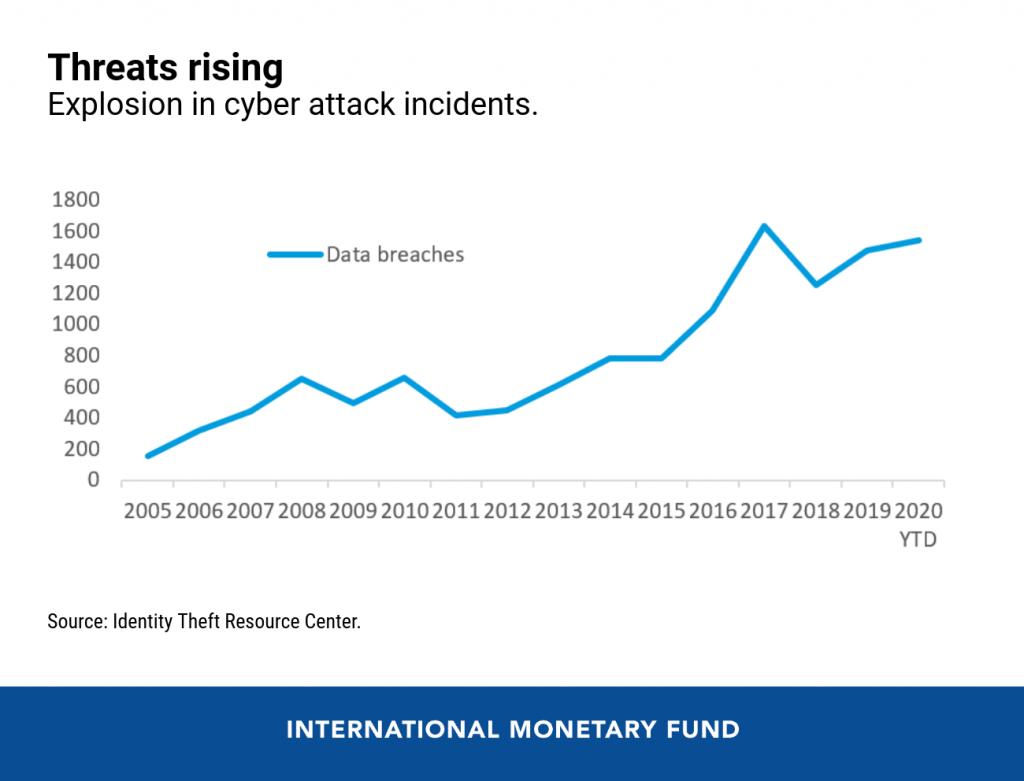

As we become increasingly reliant on digital financial services, the number of cyberattacks has tripled over the last decade, and financial services continue to be the most targeted industry. Cybersecurity has clearly become a threat to financial stability.

Given strong financial and technological interconnections, a successful attack on a major financial institution, or on a core system or service used by many, could quickly spread through the entire financial system causing widespread disruption and loss of confidence. Transactions could fail as liquidity is trapped, household and companies could lose access to deposits and payments. Under extreme scenarios, investors and depositors may demand their funds or try to cancel their accounts or other services and products they regularly use.

Hacking tools are now cheaper, simpler and more powerful, allowing…