Our Securities and Environmental, Social & Governance (ESG) teams examine the Securities and Exchange Commission’s final rules on what kinds of climate-related risks companies need to disclose to investors.

- Companies will need to disclose greenhouse gas emissions and how climate risk affects the company’s bottom line and management processes

- The disclosures must appear in registration statements and annual reports

- Ten states have already challenged the rules in the Eleventh Circuit

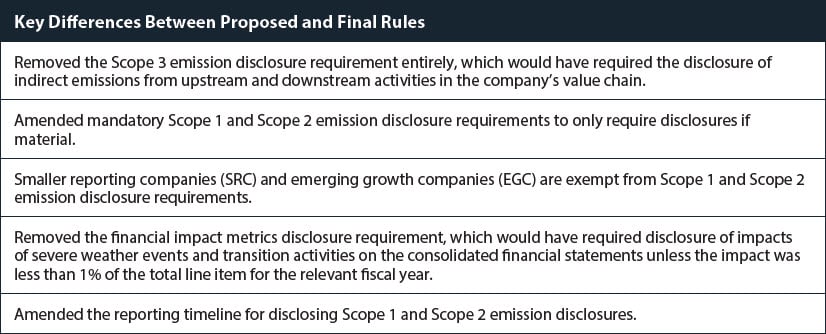

On March 21, 2022, the Securities and Exchange Commission (SEC) proposed rules intended to enhance and standardize climate-related disclosures provided by public companies. Nearly two years later, on March 6, 2024, the SEC adopted its climate risk rules that require public companies to provide certain climate-related disclosures in their registration statements and annual reports, with notable modifications due to comments received by interested parties.

New Climate-Related Disclosure Requirements

The adopted climate risk rules require issuers to:

- Disclose information related to direct and indirect greenhouse gas (GHG) emissions, if material.

- Disclose how the board of directors oversees…