Olemedia

Investment Thesis

Despite the products of Tenable (NASDAQ:TENB) being rated higher than its competitors, its revenue growth rates being decent, and its losses being manageable, Tenable is priced cheaper than almost all the competitors. Based on this, I believe that Tenable is a good buying opportunity.

In this article, I will describe:

• An introduction of Tenable

• Historical performance

• Factors influencing future performance

• Comparison of valuation and other stats

• My final take

Introducing Tenable

Tenable, Inc. is a cybersecurity firm, founded in 2002 and went public on the Nasdaq in 2018.

The company provides solutions related to “cyber exposure”, which essentially has uses such as to control, analyze, and compare cybersecurity risk.

Tenable offers products that enable insight into a range of security concerns, such as vulnerabilities, misconfigurations, internal and regulatory compliance breaches.

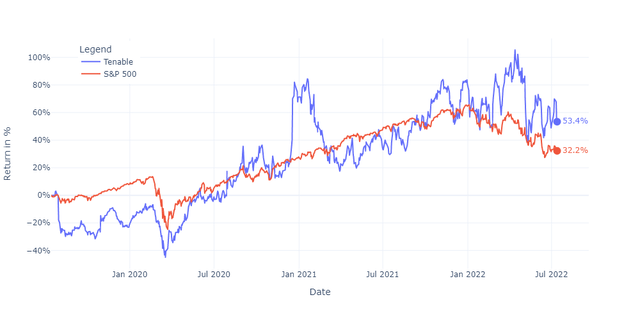

Their stock has been performing relatively well for the last three years and even outperformed the S&P 500:

Stock Performance Tenable (Prices from Yahoo Finance)

Historical Performance

Growth rates (Year-over-year)

| index | 2019 | 2020 | 2021 | Last 4 quarters |