Наши популярные онлайн курсы

In 2021, risk team implemented a quantitative risk-based approach to insurance renewals which resulted in reducing the cost of insurance by 60% and improving the quality of coverage across all insurance lines. This approach allowed us to save, or rather pay a fair price for insurance across the globe. Key to success was not to rely on market “best practices”, but on testing various hypotheses in the market and relying on data.

The first and probably the most important step is understanding the underlying risk profile. This is what in decision science would be called framing the problem. For example, once we started investigating every insurance renewal, we discovered that:

- There was no evidence to continue insuring some risks at all, given the exposure being withing shareholder risk appetite

- Limits were often completely disconnected from actual risk scenarios (usually underinsurance on property and cargo and over insurance on liability lines)

- Low deductibles made no economic sense given the cost of transfer and the cost of retention of risk.

- Low loss ratios on some of the lines which needed to be investigated.

We start by separating compulsory and voluntary insurances. Since compulsory insurances in various countries are usually heavily regulated including pricing, we try to switch to longer term policies and don’t waste time on renewals every year. On the voluntary insurance lines, we start with the discussion with the business, the internal customer, to find out: reasons for having an insurance, historical losses, perceived risk profile and other relevant information. Sometimes we find out that insurance is a requirement from customers, business partners, contractors, banks or a regulatory requirement imposed in some countries and then we switch our quant risk analysis hat on. We are very selective where it makes sense to quantify risks since it usually takes a lot of time, months of work in fact. Spoiler alert, it is totally worth it.

We spend months collecting internal data and consulting with relevant risk experts before contacting insurance markets. Once we have built a decision tree or a bow-tie diagram and a simple model for the risk we reach out to external sources – underwriters, brokers, insurers, reinsurers, rating and analytical agencies, to collect market claims data and any other relevant information. We will need external data later to compare our company risk profile against the industry and to add tail events to our model.

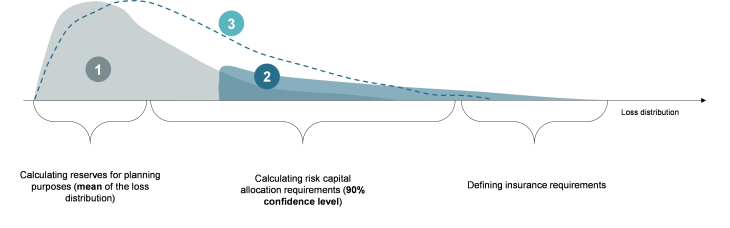

For example, for cargo insurance we investigated and risk assessed which cargoes were being transported (reviewed lots of MSDS), which routes, which ports, which ships, which risks are the most significant to the other market players, which risks are the most significant for us, what controls we have in place over these risks. Then we analyze internal and external statistics, model the distribution of expected losses for this type of risk. We could use Poisson distribution for frequency of events and Pareto or Lognormal for the consequences. Sometimes it would make sense to use a splice distribution, with GPD used to model the tail of the distribution. The limit is determined from a worst-case scenario, usually losing the biggest ship with the most expensive product transportable on that ship, given the volatility of prices. For other insurance types we often engage external risk engineers to estimate plausible worst-case scenarios. I will write a separate article on risk engineers, as it turned out what is considered industry best practices was absolutely useless to us in quantifying risk profile, so we ended up writing a whole new technical specification for the risk survey from scratch.

Sometimes, after the initial risk analysis, we would come back to business with the conclusion that insurance may not be required at all, as risk is within risk appetite and request additional information if the business insists on insurance. Recently, the customer (internal risk owner) said that he wants the same insurance limit as last year. Having collected the data, we saw that there was no evidence to suggest the same limit was necessary and a limit four times lower would cover the risk at the given confidence level.

However, we would not just exclude the higher limit, we always test multiple hypotheses in the market, this means we never make a decision without first receiving feedback from the insurance market and pricing different hypothesis. As my experience shows we actually end up increasing, no reducing, limits most of the time based on the risk profile calculated.

This is what a typical risk profile looks like:

The risk profile allows us to answer important questions before we even approach insurance markets:

- Reasonable limit for the policy

- Fair price for the policy

- Ability to test different deductible options to see which one provides better return

- Important operational risk information, including expected losses (needed for budgeting) and unexpected losses, VaR (needed for liquidity management).

The best thing about building a risk profile, the math is quite simple and replicable. We used similar models for cargo, liability, PD/BI, health and other lines. And now we are working on automating a model using Archer platform. Sign up here to find out when it goes live https://go.archerirm.co/Insight-RiskAcademy

In the next articles I will write about broker selection, preparing submissions (we do all submissions ourselves, never using broker submissions), dealing with underwriters and mapping quotes against risk profile to select the shortlist and then the best policy.

Check out other decision making books

RISK-ACADEMY offers online courses

+ Buy now

Informed Risk Taking

Learn 15 practical steps on integrating risk management into decision making, business processes, organizational culture and other activities!

149,9949,99

+ Buy now

Управление рисками

В этом коротком и очень увлекательном курсе, Алексей Сидоренко расскажет о причинах внедрения риск менеджмента, об особенностях принятия управленческих решений в ситуации неопределенности и изменениях в новом стандарте ИСО 31000:2018.

49,9919,99